Multifamily loan calculator

Multifamily Office Retail Industrial HospitalsHealthcare Self-Storage Hotel Mixed Use and. Review Guidelines for Americas top Mobile Home Park Loan Programs.

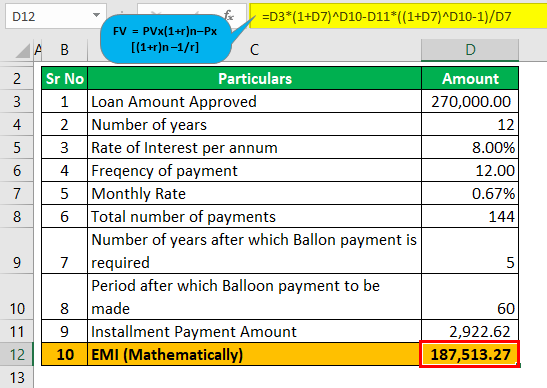

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Just because its a multifamily property doesnt mean its going to cash flow.

. In other words its designed to make cash flow. CalHFA borrowers must complete homebuyer education counseling and obtain a certificate of completion through an eligible homebuyer counseling organization. You will need to occupy the property as your primary residence.

Fixed-Rate Mortgage FRM A mortgage loan in which the interest rate remains the same for the life of the loan. Low 5 30 year fixed rates 30-year amortization Interest only available non-recourse available up to 25 Park Owned Homes allowed. Other terms and conditions apply.

Did we finance your apartment. Most lenders would consider this a good DSCR for most multifamily and commercial real estate finance transactions. If you are a homebuyer please have your loan officer walk through this with you.

Use our lookup tool to see if Freddie Mac financed your apartment building. Borrower up to 80. These variables are ever-changing however a thorough understanding of how they work together will give you a quick and easy way to value multifamily real estateeven on the back of a napkin or using your smart phone.

DUS Disclose DUS Docway DUS Gateway DUS Insights. Limits for multiple-unit properties are fixed multiples of the 1-unit limits. To see the total interest charged over time for any type of commercial loan visit our calculator on this page and look at the Total Interest under the Payment Summary chart after inputting your loan amount interest rate and amortization.

This is great for owners and sellers of multifamily properties. Use this calculator to compare CalHFA loans. Tertiary markets are only considered on an exception basis and would also require a waiver.

Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature. This loan calculator works for flips in Florida Texas California and all 50 states. A multifamily property has an NOI of 34 million and annual debt obligations of 23 million.

These median prices only directly determine the actual 1-unit loan limits when the calculated limit 115 of the median price is between the national ceiling and floor values for the loan limits. Not withstanding the number of purchasers. You can compare using various loan terms interest rates and downpayment and loan amounts.

We are proud to be a member of the Lennar family of companies. You will need to meet credit CalHFA income limits and loan requirements of the CalHFA-approved lender and the mortgage insurer. 221d4 loans are fixed and fully amortizing for 40 years not including an additional interest-only period of up to three years during construction.

Yield maintenance step-down prepayment or defeasance. The full set of county-level median price estimates for the year just. Even experienced house flippers overlook certain expenses associated with flipping properties.

You can call us at 1-800-741-8262 between 9am and 5pm EST Monday - Friday with your routing and checking account number. You may also mail a payment to us at. 34 million 23 million 148x DSCR.

Data for the September 2022 cycle will be available in the application on Sept 13 2022. Each year the National Multifamily Housing Council NMHC complies a list of the top 25 multifamily developers in the United States by unit starts. Multifamily on the other hand is generally built and sold for investment purposes.

In 2021 there were more than 400000 multifamily unit starts in the United States alone. FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. The Defeasance Calculator provides an indicative estimate of the cost of.

The FHA 221d4 loan guaranteed by HUD is the multifamily industrys highest-leverage lowest-cost non-recourse fixed-rate loan in the business. Defeasance is more complex than yield maintenance. There are many different factors that determine ones monthly cash flow.

For more information see a Sales. In multifamily finance prepayment risk is often handled through one of three methods. Learn more about Fannie Maes Multifamily library of applications.

Final loan figures may be different. Each method compensates lenders via different means should a borrower pay a loan off before it matures. In that case it would have a DSCR of 148x as seen below.

500000 063 7936507. Our preferred method of accepting a mortgage payment is by phone at no charge to you. Seattle Municipal Tower 700 5th Ave Suite 5700 Seattle WA 98104.

This is a non-recourse multifamily loan product for loan amounts starting at 750000 in primary MSAs and 1000000 in secondary MSAs. This tool is intended for loan officers and lending partners. HUD loans unlike most bank loans are almost completely asset based.

View sites for Renters Buyers and Owners. The Google Translate feature is a third-party service that is available for informational purposes only. It requires previous multifamily experience unless a waiver is attained.

Another telling factor is that multifamily starts 5 Units increased by 18 year to date through June in 2022 according to the National Association of Home Builders and will add 300000 new. Lennar Mortgage has been enriching the lives of our customers through a dedicated commitment to homeownership for more than 30 years. Use this free hard money loan spreadsheet and the other formulas we provide anytime you are considering buying a property to fix and flip.

Sales for multifamily properties started dropping in May 2022 due to increased interest rates according to the National Multifamily Housing Council. Do we own your mortgage. This tool is for estimation purposes only.

It is the largest insurer of mortgages in the world insuring over 34 million properties since its inception in 1934. Estimate your monthly mortgage payments with our easy-to-use loan calculator. Find out if Freddie Mac owns your loan using our secured lookup tool.

Property Value 7936507. Promotional value up to 15 of the loan amount for the home. The Cash Loan Drafting application is now LIVE.

Despite slowdowns related to the COVD-19 pandemic demand for multi-unit housing is stronger than ever.

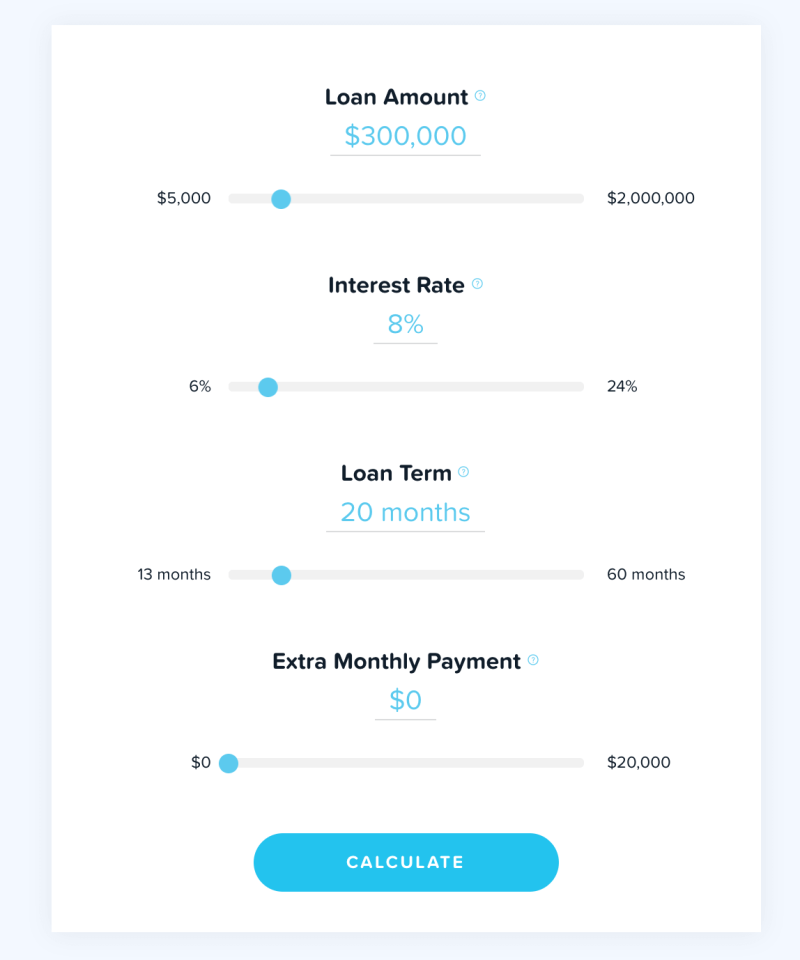

Easy Commercial Mortgage Payment Calculator Lendio

Commercial Loan Calculator Apartment Loan Calculator Apartment Loans

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

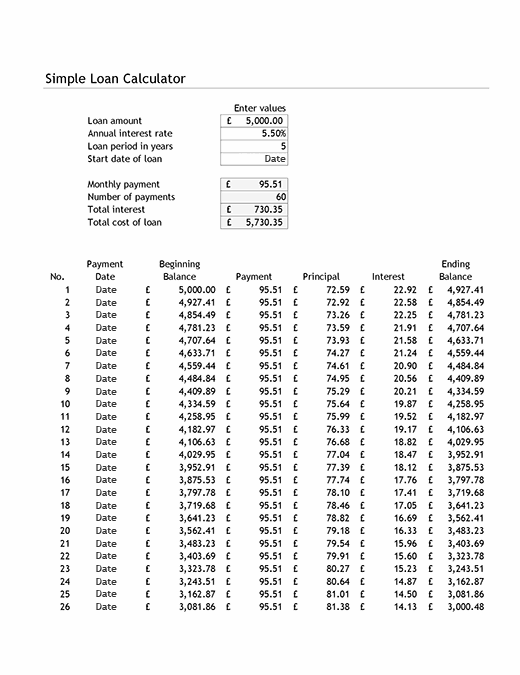

Simple Loan Calculator And Amortisation Table

Hard Money Loan Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Simple Interest Loan Calculator How It Works

Bridge Loan Calculator

![]()

Simple Interest Loan Calculator How It Works

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Loan Amortization Schedule Free For Excel

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

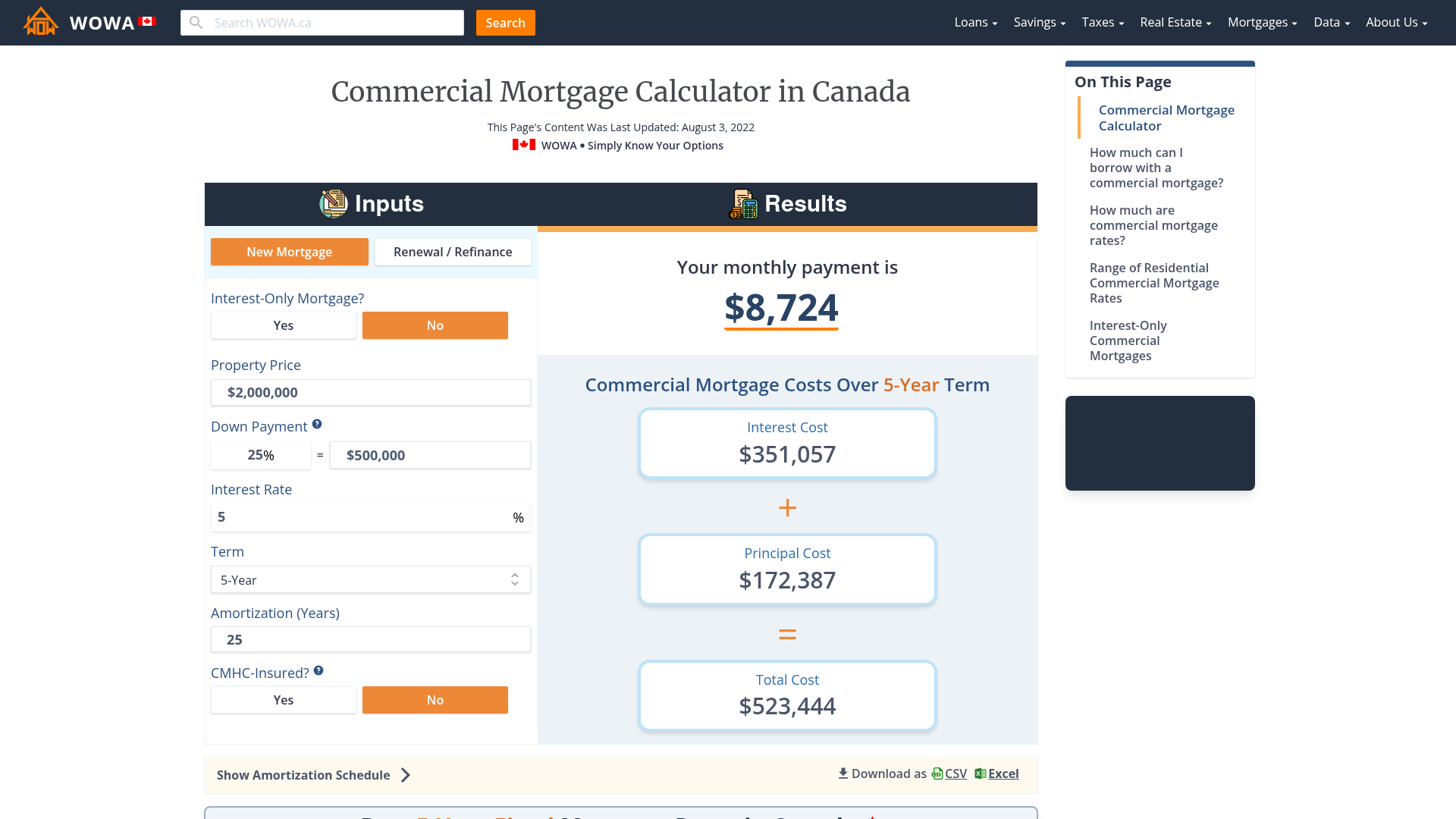

Commercial Mortgage Calculator Monthly Payment Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Bfiltqjc Ibeqm

Commercial Loan Calculator Apartment Loan Calculator Apartment Loans

Free Interest Only Loan Calculator For Excel